Why Patience Pays More Than Skill

In today’s instant-gratification culture, waiting feels uncomfortable. With one click, we can order food, stream entertainment, or buy a new gadget.

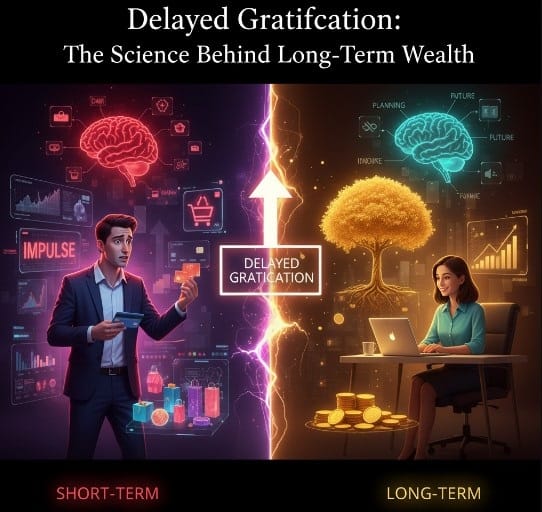

But when it comes to money, the ability to delay gratification is one of the strongest predictors of long-term wealth.

It’s not just about willpower—it’s about rewiring how the brain handles reward and temptation.

The Famous Marshmallow Experiment 🍬

In the 1970s, psychologist Walter Mischel tested kids with a marshmallow: eat one now, or wait 15 minutes and get two.

Decades later, researchers found those who waited generally had better life outcomes—higher income, better health, and stronger relationships.

The lesson? Delayed gratification builds habits that create long-term stability and success.

The Science Behind It

1. Dopamine and Rewards

Spending triggers dopamine (the “feel-good” chemical). Saving and investing delay that hit—but the eventual reward is bigger.

2. Prefrontal Cortex Power

The part of the brain that controls planning and self-control strengthens with practice, just like a muscle.

3. Future Self Connection

When people feel connected to their “future self,” they make better financial choices today.

How Delayed Gratification Builds Wealth

- Compounding Investments

Money left to grow multiplies over decades. $100 saved today can be thousands later. - Reduced Lifestyle Inflation

Choosing not to upgrade every time income rises leaves room for savings and investing. - Debt Avoidance

Waiting to buy keeps you from high-interest debt traps. - Stronger Financial Confidence

Each time you resist impulse spending, you prove to yourself that you’re in control—not your urges.

A Relatable Example

Sara, a 28-year-old designer, dreamed of buying a luxury car. Instead of financing it right away, she invested her bonus into index funds.

Three years later, her investments grew enough to cover a large down payment—without draining her savings. She got the car and kept her financial growth on track.

Her patience doubled her reward.

Practical Ways to Train Delayed Gratification

1. The 24-Hour Rule

Before any non-essential purchase, wait one day. Most impulses fade.

2. Visualize Your Future Self

Picture yourself debt-free, traveling, or financially free in 10 years. Make decisions for that person.

3. Automate Good Habits

- Auto-transfer to savings and investments.

- Use apps that lock savings to avoid temptation.

4. Start Small

Skip one impulse purchase per week and redirect the money to a savings goal.

5. Reward Strategically

Allow small “fun money” to prevent burnout. Delayed gratification works best with balance.

Why This Matters in 2025

In an economy built on instant consumption—social media ads, buy-now-pay-later apps, and rapid lifestyle trends—the ability to delay gratification is a superpower.

Those who master patience will build not just financial wealth, but emotional stability and long-term freedom.

Conclusion: The Wealth of Patience

Money grows with time—and so does character. Mastering delayed gratification isn’t about denial, it’s about choosing greater rewards over smaller ones.

🔑 Question for You: What’s one purchase you could delay this week—and how could that choice serve your future self?

Light CTA:

If this article inspired you, share it with someone chasing quick wins. True wealth is built slowly, but it lasts forever.