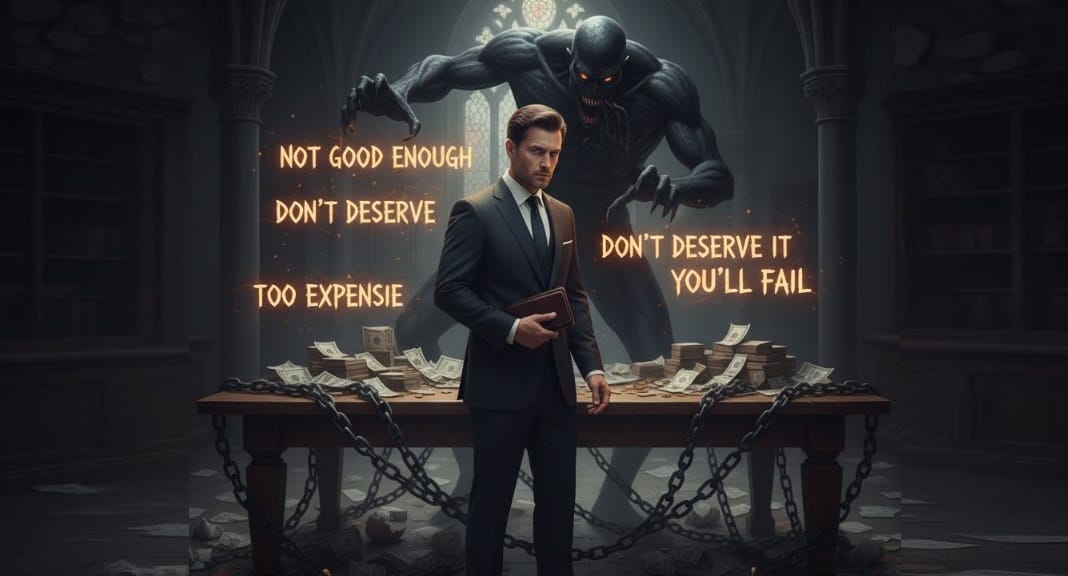

Money isn’t just about numbers—it’s deeply emotional. One of the most powerful yet overlooked influences on your financial behavior is your inner critic: the voice in your mind that judges, doubts, or criticizes your financial decisions.

This inner dialogue can shape spending habits, savings patterns, and investment choices, often without conscious awareness. Understanding and managing this internal voice is key to achieving both financial and emotional well-being.

1. Who Is Your Inner Critic?

Your inner critic is a combination of:

- Childhood lessons about money (“Don’t be wasteful,” “Money doesn’t grow on trees”)

- Cultural and societal messages about success, scarcity, or consumerism

- Past financial experiences, mistakes, or losses

It shows up as self-doubt, guilt, fear, or judgment around money, influencing both conscious and subconscious financial decisions.

2. The Ways the Inner Critic Influences Money Behavior

A. Overspending to Prove Worth

Negative self-talk can trigger compensatory spending—buying items to feel competent, successful, or accepted.

B. Paralyzing Over-Saving

Fear of making mistakes or being judged may lead to hoarding money, refusing to spend even for necessary or fulfilling purposes.

C. Risk Aversion

The inner critic exaggerates potential negative outcomes, causing avoidance of investments, business opportunities, or calculated financial risks.

D. Impulsive or Emotional Decisions

Criticism and anxiety can prompt quick, reactive choices to soothe stress, like unplanned purchases or risky trades.

E. Self-Sabotage

Beliefs such as “I don’t deserve financial success” or “I’m bad with money” can create patterns that undermine wealth-building, even when income and resources are sufficient.

3. Emotional and Psychological Roots

Your inner critic develops from:

- Early Money Messages: Parents, teachers, or peers who instilled fear or shame around finances

- Past Mistakes or Failures: Negative experiences with debt, loss, or poor decisions

- Cultural Narratives: Societal pressure to earn, spend, or save in ways that may not align with personal values

- Comparison and Social Media: Seeing others’ financial success can fuel self-doubt and criticism

These roots can make financial decisions emotionally charged rather than rational.

4. Recognizing Your Inner Critic in Action

Signs your inner critic is affecting your wallet include:

- Feeling guilt after spending on necessary items

- Obsessing over every financial decision

- Avoiding investing or opportunities due to fear of loss

- Experiencing anxiety when reviewing bank accounts

- Feeling undeserving of financial success or comfort

Awareness is the first step toward regaining control and clarity.

5. Strategies to Manage the Inner Critic and Improve Financial Health

A. Name and Observe It

Identify the critical voice without judgment. Give it a label (“the inner critic”) and observe when it appears.

B. Challenge Negative Beliefs

Question thoughts like:

- “I’m bad with money” → “I’m learning to manage money responsibly.”

- “I don’t deserve financial success” → “I am capable of creating and managing wealth.”

C. Reframe Money as a Tool, Not a Test

Shift the perspective from judgment to empowerment: money supports goals, freedom, and growth, not validation.

D. Create Intentional Financial Systems

Budgeting, automatic savings, and investment plans reduce the emotional influence of the critic.

E. Practice Mindfulness and Emotional Regulation

Notice anxiety, guilt, or fear around money. Pause before decisions and respond intentionally.

F. Seek Professional Guidance

Financial coaches or therapists trained in emotional finance can help address underlying trauma, negative patterns, and self-sabotaging behaviors.

6. Turning Awareness Into Action

Managing your inner critic allows you to:

- Make confident, rational financial decisions

- Reduce anxiety and stress around money

- Align spending and saving with your values

- Build wealth without guilt or fear

- Foster healthier relationships with partners, family, and peers regarding money

The goal isn’t to silence the inner critic completely—it’s to transform its energy into awareness and action rather than letting it dictate financial behavior.

Conclusion

Your inner critic has likely shaped financial decisions for years—sometimes holding you back without your conscious knowledge. By recognizing, understanding, and strategically managing this internal voice, you can overcome fear, self-doubt, and negative patterns, creating a healthier, more empowered relationship with money.

Financial success isn’t just about income or assets—it’s about mastering your mindset, embracing awareness, and making intentional choices that align with your values and goals.