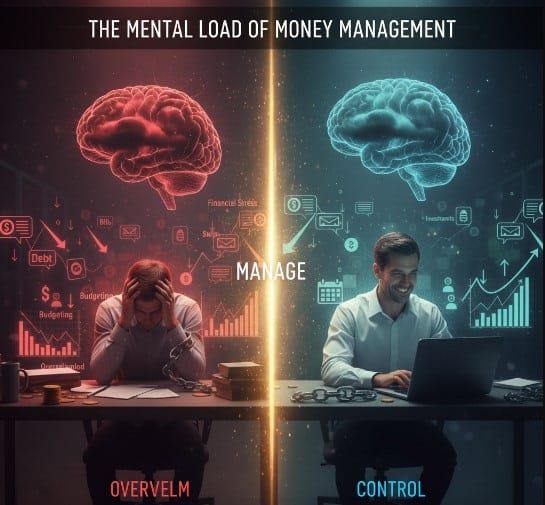

Why Money Management Feels So Heavy

On paper, managing money sounds simple: track income, pay bills, save, and invest.

But in reality, money comes with a mental load—the invisible, ongoing weight of constantly thinking about financial choices:

- “Did I pay the electricity bill?”

- “Do I have enough for next month’s rent?”

- “Should I invest now or wait?”

This constant background noise drains energy, even when your finances look “okay” on the outside.

What Is the Mental Load of Money?

The “mental load” is the hidden work of keeping track of tasks in your mind. With money, it looks like:

- Juggling bills, savings, and debt at once.

- Anticipating future expenses.

- Making dozens of small spending decisions daily.

- Carrying guilt or stress about mistakes.

It’s like having 20 browser tabs open in your head—all about money.

The Psychology Behind It

Money management is tied to:

- Decision Fatigue: Every choice (coffee or no coffee, save or spend) drains willpower.

- Fear of Mistakes: One wrong decision feels like it could ruin everything.

- Emotional Baggage: Childhood money habits or past financial struggles resurface.

No wonder so many people feel anxious about “just keeping up.”

Signs You’re Carrying Too Much Mental Load

- Constantly worrying about bills or debt.

- Feeling guilty even when you spend wisely.

- Avoiding financial check-ins because it’s overwhelming.

- Trouble sleeping due to money thoughts.

- Struggling to focus because finances are “always in the back of your mind.”

How to Lighten the Mental Load

1. Automate What You Can

- Auto-pay recurring bills.

- Auto-transfer to savings/investments.

- Let systems do the heavy lifting instead of your brain.

2. Use the “One Hour Rule”

Dedicate one focused hour weekly to review money, instead of worrying every day.

3. Write It Down, Don’t Carry It

Use a notebook or finance app to track bills, goals, and deadlines—get it out of your head.

4. Break Goals Into Smaller Pieces

“Save for retirement” is vague. Instead: “Save $200 this month.” Small steps reduce overwhelm.

5. Release the Guilt

Remind yourself: money management is a skill, not a test of worth. Mistakes are part of the process.

Real-Life Story

When James started his first job, he thought budgeting apps would solve everything. Instead, he found himself stressed, always second-guessing decisions.

The shift? He automated his bills, set one Sunday each week as “money review,” and stopped tracking every coffee. Result: less stress, more clarity, and steady financial growth.

Looking Ahead: The Mental Load in a Digital Age

In 2025, with AI budgeting tools and endless finance apps, the risk is information overload.

The solution isn’t more tools—it’s smarter systems. Choose a few tools you trust, automate, and keep things simple.

Conclusion: Money Should Support Your Life, Not Control It

The mental load of money management is real—but it doesn’t have to weigh you down forever. By automating, simplifying, and reframing how you view money, you can regain peace of mind and focus on living, not just budgeting.

🔑 Question for You: What’s one money task you could automate today to give your mind more freedom?

Light CTA:

If this article helped you rethink money stress, share it with a friend who might be carrying the same mental load. A lighter mindset can be contagious.