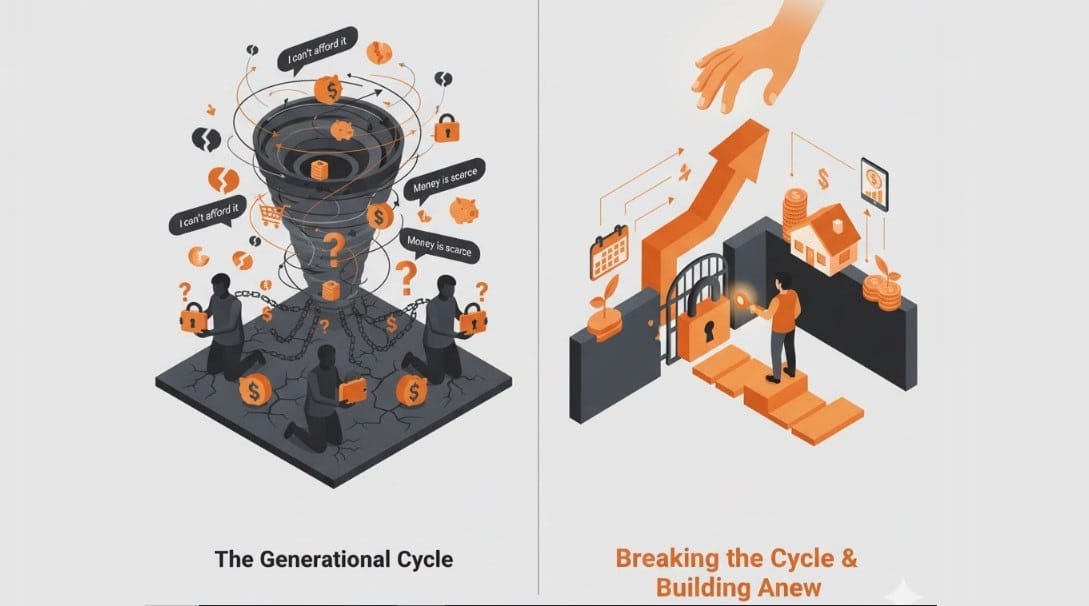

Did you know that many of your money habits were shaped long before you even earned your first paycheck?

Money beliefs are often passed down unconsciously from parents, grandparents, and cultural environment.

From fear of scarcity to avoidance of investing, these inherited beliefs influence how you earn, spend, save, and think about wealth.

Recognizing and breaking generational money patterns is crucial for building financial freedom and emotional well-being.

1. How Money Beliefs Are Passed Down

Generational money beliefs develop through:

- Direct teaching: Statements like “Money doesn’t grow on trees” or “Rich people are greedy.”

- Observation: Watching how parents handle debt, budgeting, or spending.

- Emotional imprinting: Associating money with fear, shame, or conflict.

- Cultural norms: Societal messages about success, wealth, or poverty.

These beliefs often operate subconsciously, affecting your decisions without you realizing it.

2. Common Generational Money Beliefs

Some patterns commonly observed across families:

- Scarcity mindset: “We never have enough.”

- Fear of risk: Avoiding investments or entrepreneurship.

- Spending avoidance: Guilt or shame associated with enjoying money.

- Work-obsessed mindset: Valuing income over financial intelligence.

- Money as conflict: Associating wealth with family tension.

Even if your financial situation has improved, these beliefs can silently undermine your progress.

3. The Emotional Consequences

Inherited money beliefs don’t just impact your bank account—they affect your emotional well-being:

- Chronic anxiety about finances

- Guilt or shame around spending

- Difficulty asking for raises or negotiating

- Self-sabotage with money goals

- Feeling unworthy of financial success

Awareness is the first step in breaking the cycle.

4. How to Identify Your Money Patterns

Start by examining your financial history and emotions:

- What money messages did you hear growing up?

- How did your parents handle debt, saving, and spending?

- What emotions surface when you think about wealth or financial decisions?

- Are your financial habits empowering or fear-driven?

Writing down your observations helps reveal subconscious patterns.

5. Rewriting Generational Money Beliefs

Once identified, generational beliefs can be rewired with conscious practice:

Step 1: Challenge Limiting Beliefs

Ask: “Is this belief helping me achieve my financial goals or holding me back?”

Step 2: Replace with Empowering Narratives

Examples:

- “I deserve financial security and abundance.”

- “Wealth is a tool to create freedom and impact.”

- “I can learn to manage money intelligently.”

Step 3: Build New Habits

Practice behaviors that reinforce healthy beliefs:

- Budgeting and saving regularly

- Investing and taking calculated risks

- Tracking spending without guilt

- Celebrating small financial wins

6. Involve the Next Generation

Breaking the cycle isn’t just personal—it’s generational.

Teach children and younger family members:

- Healthy money habits

- Positive language about wealth

- The emotional neutrality of money

- The importance of financial education

By doing so, you stop fear and scarcity from continuing through the family line.

7. Embracing Financial Freedom

Breaking generational money beliefs leads to:

- Emotional clarity around financial decisions

- Improved confidence in earning and investing

- Greater ability to set and achieve financial goals

- Healthier relationships with money and family

Financial freedom begins not in the bank account, but in the mind.

Conclusion

Your money beliefs are powerful—and many were inherited long before you understood them.

By identifying, understanding, and consciously rewriting these patterns, you can break free from fear-based financial behavior and create a healthier, wealth-positive life.

You have the power to end generational financial limitations and design a future where money serves your life, not controls it.